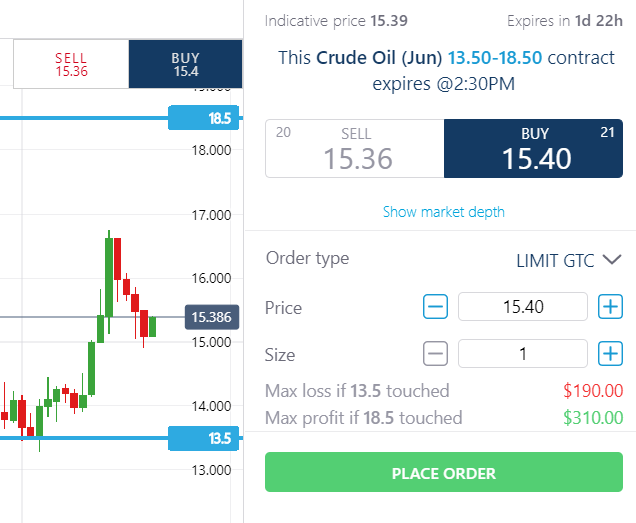

Of all Nadex contracts, knock-outs most closely mirror the movement of the underlying indicative index. One of two things will happen: The floor or ceiling is hit and you’re knocked out of the trade, taking your maximum profit or loss. The contract expires resulting in a variable return. Knock-outs have a maximum duration of one week Step 2: pick your market. We list knock-outs for three market classes: Stock indices. Forex. Commodities. Picking a market will show you the current indicative price and the knock-out ranges available. There are generally four knock-out contracts available on each market; they always have a weekly expiration Knock-out contracts are financial instruments that offer opportunities to speculate on the markets with a set floor and ceiling. You can make money if the market moves in the direction you predict. If the floor or ceiling is hit, you’re knocked out of the trade – if you’ve made a profit, it’s yours to keep, and if you’ve taken a loss

Nadex Expands Offering with New Knock Outs and Call Spreads

By entering your email you consent to receive communication from us per our Privacy Policy. Trade your way. Sign up securely. Trade today. What are some popular markets on Nadex? Practice is free. Begin demo. When, nadex knock out, where and as much as you want. Trade 23 hours a day, 5 days a week. Trade from your phone, tablet or desktop. No pattern day trading rules. Low entry cost. Trading on Nadex involves risk and may not be appropriate for all.

Members risk losing their cost to enter any transaction, including fees. You should carefully consider nadex knock out trading on Nadex is appropriate nadex knock out you in light of your investment experience and financial resources, nadex knock out. Any trading decisions you make are solely your responsibility and at your own risk. Past performance is not necessarily indicative of future results.

None of the material included herein is to be construed as a solicitation, recommendation or offer to buy or nadex knock out any financial instrument on Nadex or elsewhere. Nadex is subject to U. regulatory oversight by the CFTC. Knowledge is power. Access our learning resources to get free knowledge — customize your strategy and gain a competitive edge when trading.

Learn to trade with Nadex. FTSE — FTSE based on Liffe FTSE ® Index Futures: tracking the largest UK companies by market cap. DE30 — DE based on Eurex DAX® Index Futures: tracking 30 major Nadex knock out companies on the Frankfurt Stock Exchange. Day Traders, meet your match. So how do I trade knock-outs? Step 1: Choose your market forex, stock indices, commodities.

Step 2: Select a contract and make a prediction—this will determine your set floor and ceiling. Choose your order ticket price and size. Step 3: Place your trade.

Step 4: Wait for expiration, or close out early, nadex knock out. Close out any time to protect profits or limit losses. Why should I trade knock-outs? Other nadex knock out reasons…. Simple pricing. Limited risk. Clear profit targets. Popular markets. Flexible trading times. Great value. A knock-out contract is structured with a floor and a ceiling, giving you a built-in trading plan. More on those next, nadex knock out.

So, what's a knock-out, anyway? Knock-out contracts are financial instruments that offer opportunities to speculate on the markets with a set floor and ceiling.

You can make money if the market moves in the direction you predict. All knock-out trades are limited risk and you will know the maximum possible loss or profit upfront, giving you a built-in plan for every trade right from the start. Knock-outs are exciting short-term contracts, specifically designed for day traders. Give it a go. Low barrier to entry. Built-in trading discipline. Good traders understand their risks. Set your floor, set your ceiling—knock-outs put you in control.

Day trading, reimagined. Go ahead, have a little fun. Try knock-outs in a no-stakes environment before opening a trading account, nadex knock out. Put your market knowledge to work. You know the markets, from forex to stock indices to commodities.

Take advantage of this knowledge in an entirely new way, on your own terms. Exhilarating trades are just a click away. Try knock-outs for free with a practice account, then open a live account and put your new skills to the test.

Get in on the action. Enjoy the non-stop action of day trading, without being bound by daily limits. Unlimited trades. This just might be your new favorite trade. Other good reasons… Simple pricing Limited risk Clear profit targets Popular markets Flexible trading times Great value, nadex knock out.

How I Trade Nadex Products: Profiting 257% on a Knockout Long and 119% on a Binary Short

, time: 14:23Nadex Review - Is It Safe And Legit?

21/04/ · These products provide an opportunity to take a directional trade in FX pairs, commodities, and indices that is easy to understand and has clearly defined risk vs. reward. You’ll learn how to analyze and trade these contracts on the Nadex platform and see specific examples of each. An Intro to Nadex Knock Outs & Call Spreads - Apr. 21 Knock-out contracts are financial instruments that offer opportunities to speculate on the markets with a set floor and ceiling. You can make money if the market moves in the direction you predict. If the floor or ceiling is hit, you’re knocked out of the trade – if you’ve made a profit, it’s yours to keep, and if you’ve taken a loss Of all Nadex contracts, knock-outs most closely mirror the movement of the underlying indicative index. One of two things will happen: The floor or ceiling is hit and you’re knocked out of the trade, taking your maximum profit or loss. The contract expires resulting in a variable return. Knock-outs have a maximum duration of one week

No comments:

Post a Comment